Chatbots for banking 🏦

Transform the banking experience with conversational AI. Bring efficiency, personalization and security.

Boost your business interaction with AI-powered chatbots

Boost your marketing strategy with WhatsApp templates

Offer immediate and personalised contact to your customers, boost real-time communication.

Optimise your customer service with our Ticketing Automation solution.

Automate, manage and improve your team’s efficiency with internal chatbots/helpdesk

Boost business growth by analysing performance and assessing efficiency

AI technologies combined for effective cross-channel conversations

Integrates GPT to further enrich customer conversations

Customer service

Marketing

Sales

Ecommerce

Services

Tourism

Logistics

Banking

Insurance

Telco

Public Administrations

Health

Restoration

Success stories

About us

Contact

Partners

Prices

Blog

Premium Content

ROI calculator

COMPANIES THAT ALREADY TRUST AUNOA

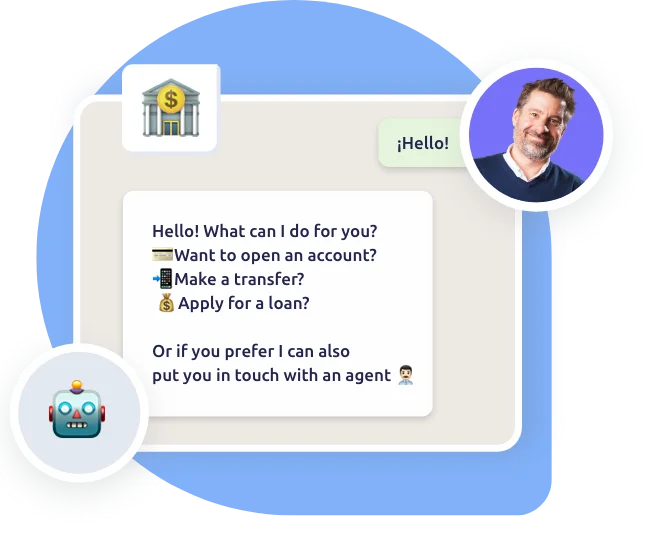

Conversational banking is an innovative way to interact with customers through conversational solutions, leveraging artificial intelligence to deliver a personalized and efficient experience. I want to know more.

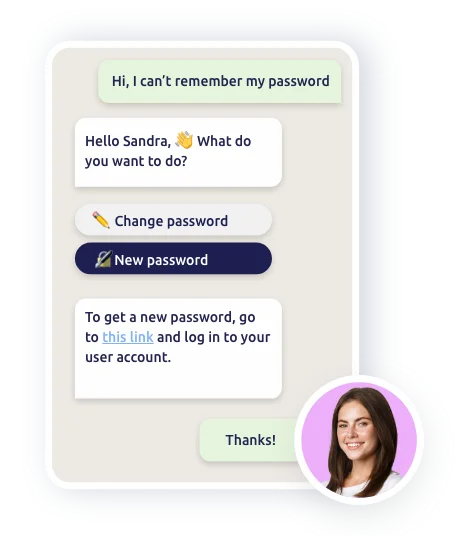

Authenticates accounts to ensure user security.

Notifies suspicious activity to prevent fraud.

Communicates security features to promote customer confidence.

Provides omnichannel communications for a seamless experience.

Implements contextual messaging for more relevant interactions.

Offers digital promotions to enhance customer relationships.

Unify customer data for a more personalised service.

Customise the ATC to resolve queries more efficiently.

Automate service notifications to keep customers informed.

Authenticates accounts to ensure user security.

Notifies suspicious activity to prevent fraud.

Communicates security features to promote customer confidence.

Provides omnichannel communications for a seamless experience.

Implements contextual messaging for more relevant interactions.

Offers digital promotions to enhance customer relationships.

Unify customer data for a more personalised service.

Customise the ATC to resolve queries more efficiently.

Automate service notifications to keep customers informed.

Customer service preferences by generation.

Adapting to the preferences of each generation is the key to ensure a smooth and satisfying experience

Prefer attention through apps such as WhatsApp

Prefer attention through apps such as WhatsApp

The banking and financial industry has undergone a major transformation in its communication methods.

At Aunoa we understand that you need to be right where your customers are. We power banking with conversational solutions on the most popular messaging channels.

Prioritize customer needs to create the banking experience.

Provides customer service tailored to each customer's individual needs, using chatbots that collect data to provide personalized responses and recommendations

Give your customers the ability to resolve queries and make transactions quickly and easily through intuitive chatbots, improving efficiency and customer satisfaction.

Integrate chatbots into your digital strategy to automate processes, manage multiple communication channels and provide analytics on customer interactions

Implement chatbots with natural language and empathy capabilities to offer more human and closer interactions. Strengthen the bond with your brand Strengthen the link with your brand.

Find out how financial chatbots can drive your business success.

Chatbots for banks that make everyday tasks easier for customers.

User registration

Authentication

Location of

branches and ATMs

Outlay analysis

Lost card

reporting

Recommendations

of services

Integrate a chatbot into the channels your customers prefer to deliver an omnichannel experience across conversational channels.

Our chatbots connect easily with the main CMR software, Support, payment gateways and with your business management tools.

Integrations, AI training, automation design and production launch in 4 weeks.

We help you choose the best solution to automate your Customer Service and design a tailored conversational experience.

Our technology easily integrates with Customer Service Software, CRMs and digital channels such as WhatsApp and Social Networks.

Proactive training and daily monitoring of AI to ensure optimal performance and continuous improvement.

All the information you need to understand and improve Customer Service, processes and productivity in the banking sector. Increase the value of your brand, discover the Aunoa world.